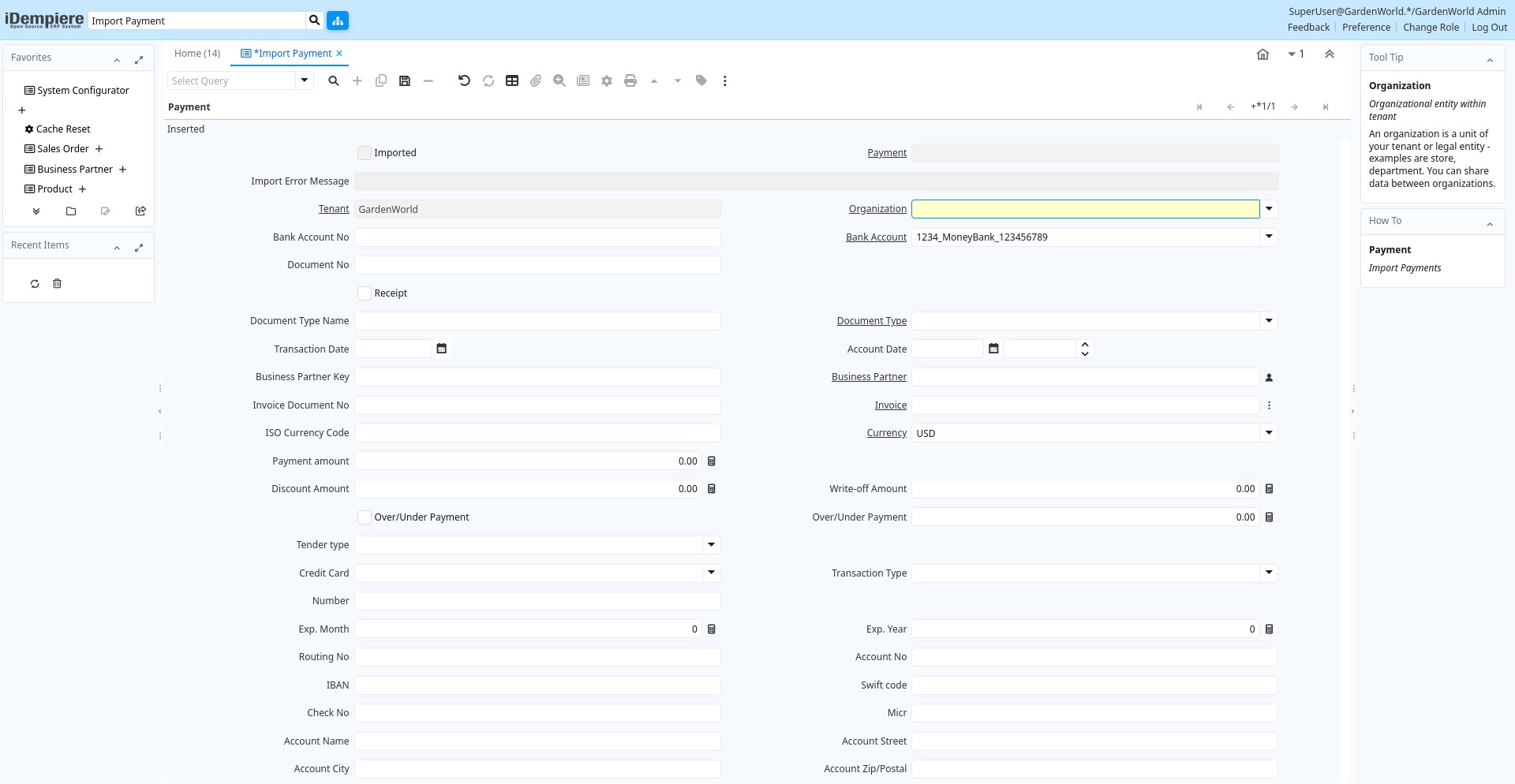

Window: Import Payment

[Created: 07/06/2003 - Updated: 03/06/2021 ]

Description: Import Payments

Help:

Tab: Payment

[Created: 07/06/2003 - Updated: 02/01/2000 ]

Description: Import Payments

Help:

Tab Level: 0

Table 10: Payment - Fields

Table: Report Parameters

| Name | Description | Help | Technical Info |

|---|---|---|---|

| Import Payment | Import Payment | i_payment.I_Payment_ID numeric(10) ID | |

| Imported | Has this import been processed | The Imported check box indicates if this import has been processed. | i_payment.I_IsImported character(1) Yes-No |

| Payment | Payment identifier | The Payment is a unique identifier of this payment. | i_payment.C_Payment_ID numeric(10) Search |

| Import Error Message | Messages generated from import process | The Import Error Message displays any error messages generated during the import process. | i_payment.I_ErrorMsg character varying(2000) String |

| Tenant | Tenant for this installation. | A Tenant is a company or a legal entity. You cannot share data between Tenants. | i_payment.AD_Client_ID numeric(10) Table Direct |

| Organization | Organizational entity within tenant | An organization is a unit of your tenant or legal entity - examples are store, department. You can share data between organizations. | i_payment.AD_Org_ID numeric(10) Table Direct |

| Bank Account No | Bank Account Number | i_payment.BankAccountNo character varying(20) String | |

| Bank Account | Account at the Bank | The Bank Account identifies an account at this Bank. | i_payment.C_BankAccount_ID numeric(10) Table Direct |

| Document No | Document sequence number of the document | The document number is usually automatically generated by the system and determined by the document type of the document. If the document is not saved, the preliminary number is displayed in "".If the document type of your document has no automatic document sequence defined, the field is empty if you create a new document. This is for documents which usually have an external number (like vendor invoice). If you leave the field empty, the system will generate a document number for you. The document sequence used for this fallback number is defined in the "Maintain Sequence" window with the name "DocumentNo_", where TableName is the actual name of the table (e.g. C_Order). | i_payment.DocumentNo character varying(30) String |

| Receipt | This is a sales transaction (receipt) | i_payment.IsReceipt character(1) Yes-No | |

| Document Type Name | Name of the Document Type | i_payment.DocTypeName character varying(60) String | |

| Document Type | Document type or rules | The Document Type determines document sequence and processing rules | i_payment.C_DocType_ID numeric(10) Table Direct |

| Transaction Date | Transaction Date | The Transaction Date indicates the date of the transaction. | i_payment.DateTrx timestamp without time zone Date |

| Account Date | Accounting Date | The Accounting Date indicates the date to be used on the General Ledger account entries generated from this document. It is also used for any currency conversion. | i_payment.DateAcct timestamp without time zone Date+Time |

| Business Partner Key | Key of the Business Partner | i_payment.BPartnerValue character varying(40) String | |

| Business Partner | Identifies a Business Partner | A Business Partner is anyone with whom you transact. This can include Vendor, Customer, Employee or Salesperson | i_payment.C_BPartner_ID numeric(10) Search |

| Invoice Document No | Document Number of the Invoice | i_payment.InvoiceDocumentNo character varying(30) String | |

| Invoice | Invoice Identifier | The Invoice Document. | i_payment.C_Invoice_ID numeric(10) Search |

| ISO Currency Code | Three letter ISO 4217 Code of the Currency | For details - http://www.unece.org/trade/rec/rec09en.htm | i_payment.ISO_Code character(3) String |

| Currency | The Currency for this record | Indicates the Currency to be used when processing or reporting on this record | i_payment.C_Currency_ID numeric(10) Table Direct |

| Payment amount | Amount being paid | Indicates the amount this payment is for. The payment amount can be for single or multiple invoices or a partial payment for an invoice. | i_payment.PayAmt numeric Amount |

| Discount Amount | Calculated amount of discount | The Discount Amount indicates the discount amount for a document or line. | i_payment.DiscountAmt numeric Amount |

| Write-off Amount | Amount to write-off | The Write Off Amount indicates the amount to be written off as uncollectible. | i_payment.WriteOffAmt numeric Amount |

| Over/Under Payment | Over-Payment (unallocated) or Under-Payment (partial payment) | Overpayments (negative) are unallocated amounts and allow you to receive money for more than the particular invoice. Underpayments (positive) is a partial payment for the invoice. You do not write off the unpaid amount. | i_payment.IsOverUnderPayment character(1) Yes-No |

| Over/Under Payment | Over-Payment (unallocated) or Under-Payment (partial payment) Amount | Overpayments (negative) are unallocated amounts and allow you to receive money for more than the particular invoice. Underpayments (positive) is a partial payment for the invoice. You do not write off the unpaid amount. | i_payment.OverUnderAmt numeric Amount |

| Tender type | Method of Payment | The Tender Type indicates the method of payment (ACH or Direct Deposit, Credit Card, Check, Direct Debit) | i_payment.TenderType character(1) List |

| Credit Card | Credit Card (Visa, MC, AmEx) | The Credit Card drop down list box is used for selecting the type of Credit Card presented for payment. | i_payment.CreditCardType character(1) List |

| Transaction Type | Type of credit card transaction | The Transaction Type indicates the type of transaction to be submitted to the Credit Card Company. | i_payment.TrxType character(1) List |

| Number | Credit Card Number | The Credit Card number indicates the number on the credit card, without blanks or spaces. | i_payment.CreditCardNumber character varying(20) String |

| Exp. Month | Expiry Month | The Expiry Month indicates the expiry month for this credit card. | i_payment.CreditCardExpMM numeric(10) Integer |

| Exp. Year | Expiry Year | The Expiry Year indicates the expiry year for this credit card. | i_payment.CreditCardExpYY numeric(10) Integer |

| Routing No | Bank Routing Number | The Bank Routing Number (ABA Number) identifies a legal Bank. It is used in routing checks and electronic transactions. | i_payment.RoutingNo character varying(20) String |

| Account No | Account Number | The Account Number indicates the Number assigned to this bank account. | i_payment.AccountNo character varying(20) String |

| IBAN | International Bank Account Number | If your bank provides an International Bank Account Number, enter it hereDetails ISO 13616 and http://www.ecbs.org. The account number has the maximum length of 22 characters (without spaces). The IBAN is often printed with a apace after 4 characters. Do not enter the spaces in iDempiere. | i_payment.IBAN character varying(40) String |

| Swift code | Swift Code or BIC | The Swift Code (Society of Worldwide Interbank Financial Telecommunications) or BIC (Bank Identifier Code) is an identifier of a Bank. The first 4 characters are the bank code, followed by the 2 character country code, the two character location code and optional 3 character branch code. For details see http://www.swift.com/biconline/index.cfm | i_payment.SwiftCode character varying(20) String |

| Check No | Check Number | The Check Number indicates the number on the check. | i_payment.CheckNo character varying(20) String |

| Micr | Combination of routing no, account and check no | The Micr number is the combination of the bank routing number, account number and check number | i_payment.Micr character varying(20) String |

| Account Name | Name on Credit Card or Account holder | The Name of the Credit Card or Account holder. | i_payment.A_Name character varying(60) String |

| Account Street | Street address of the Credit Card or Account holder | The Street Address of the Credit Card or Account holder. | i_payment.A_Street character varying(60) String |

| Account City | City or the Credit Card or Account Holder | The Account City indicates the City of the Credit Card or Account holder | i_payment.A_City character varying(60) String |

| Account Zip/Postal | Zip Code of the Credit Card or Account Holder | The Zip Code of the Credit Card or Account Holder. | i_payment.A_Zip character varying(20) String |

| Account State | State of the Credit Card or Account holder | The State of the Credit Card or Account holder | i_payment.A_State character varying(40) String |

| Account Country | Country | Account Country Name | i_payment.A_Country character varying(40) String |

| Driver License | Payment Identification - Driver License | The Driver's License being used as identification. | i_payment.A_Ident_DL character varying(20) String |

| Social Security No | Payment Identification - Social Security No | The Social Security number being used as identification. | i_payment.A_Ident_SSN character varying(20) String |

| Account EMail | Email Address | The EMail Address indicates the EMail address off the Credit Card or Account holder. | i_payment.A_EMail character varying(60) String |

| Voice authorization code | Voice Authorization Code from credit card company | The Voice Authorization Code indicates the code received from the Credit Card Company. | i_payment.VoiceAuthCode character varying(20) String |

| Original Transaction ID | Original Transaction ID | The Original Transaction ID is used for reversing transactions and indicates the transaction that has been reversed. | i_payment.Orig_TrxID character varying(20) String |

| Approved | Indicates if this document requires approval | The Approved checkbox indicates if this document requires approval before it can be processed. | i_payment.IsApproved character(1) Yes-No |

| Result | Result of transmission | The Response Result indicates the result of the transmission to the Credit Card Company. | i_payment.R_Result character varying(20) String |

| Response Message | Response message | The Response Message indicates the message returned from the Credit Card Company as the result of a transmission | i_payment.R_RespMsg character varying(60) String |

| Reference | Payment reference | The Payment Reference indicates the reference returned from the Credit Card Company for a payment | i_payment.R_PnRef character varying(20) String |

| Authorization Code | Authorization Code returned | The Authorization Code indicates the code returned from the electronic transmission. | i_payment.R_AuthCode character varying(20) String |

| Import Payments | Import Payments | The Parameters are default values for null import record values, they do not overwrite any data. | i_payment.Processing character(1) Button |