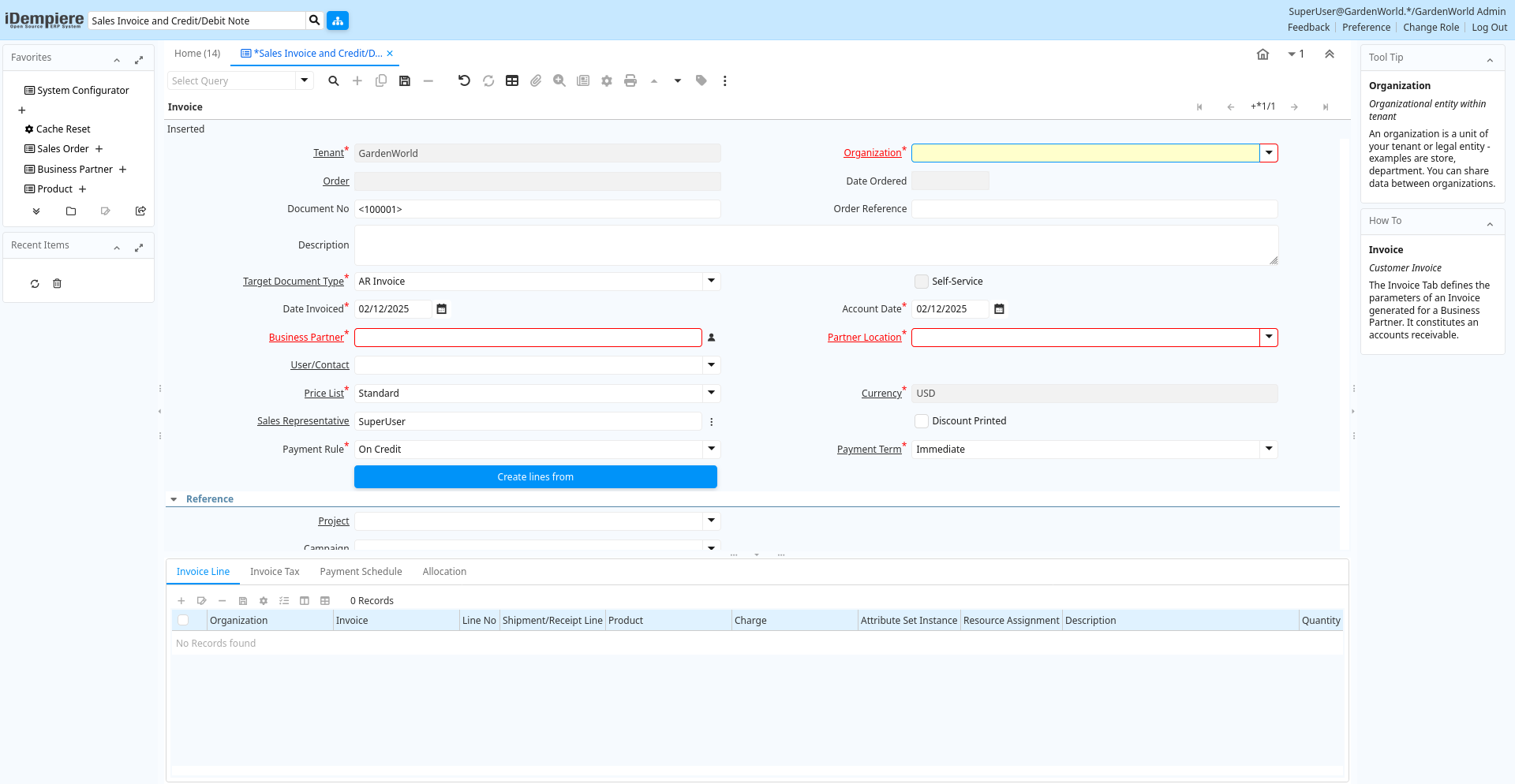

Window: Sales Invoice and Credit/Debit Note

[Created: 19/12/1999 - Updated: 08/12/2023 ]

Description: Customer Sales Invoice and Credit/Debit Note

Help: The Customer Invoice Window allows you to display and enter invoices for a customer. Invoices can also be generated from Sales Orders or Delivery documents.

Tab: Invoice

[Created: 19/12/1999 - Updated: 30/09/2009 ]

Description: Customer Invoice

Help: The Invoice Tab defines the parameters of an Invoice generated for a Business Partner. It constitutes an accounts receivable.

Tab Level: 0

Table 10: Invoice - Fields

Table: Report Parameters

| Name | Description | Help | Technical Info |

|---|---|---|---|

| Tenant | Tenant for this installation. | A Tenant is a company or a legal entity. You cannot share data between Tenants. | c_invoice.AD_Client_ID numeric(10) Table Direct |

| Organization | Organizational entity within tenant | An organization is a unit of your tenant or legal entity - examples are store, department. You can share data between organizations. | c_invoice.AD_Org_ID numeric(10) Table Direct |

| Order | Order | The Order is a control document. The Order is complete when the quantity ordered is the same as the quantity shipped and invoiced. When you close an order, unshipped (backordered) quantities are cancelled. | c_invoice.C_Order_ID numeric(10) Search |

| Date Ordered | Date of Order | Indicates the Date an item was ordered. | c_invoice.DateOrdered timestamp without time zone Date |

| Document No | Document sequence number of the document | The document number is usually automatically generated by the system and determined by the document type of the document. If the document is not saved, the preliminary number is displayed in "".If the document type of your document has no automatic document sequence defined, the field is empty if you create a new document. This is for documents which usually have an external number (like vendor invoice). If you leave the field empty, the system will generate a document number for you. The document sequence used for this fallback number is defined in the "Maintain Sequence" window with the name "DocumentNo_", where TableName is the actual name of the table (e.g. C_Order). | c_invoice.DocumentNo character varying(30) String |

| Order Reference | Transaction Reference Number (Sales Order, Purchase Order) of your Business Partner | The business partner order reference is the order reference for this specific transaction; Often Purchase Order numbers are given to print on Invoices for easier reference. A standard number can be defined in the Business Partner (Customer) window. | c_invoice.POReference character varying(20) String |

| Description | Optional short description of the record | A description is limited to 255 characters. | c_invoice.Description character varying(255) Text |

| Target Document Type | Target document type for conversing documents | You can convert document types (e.g. from Offer to Order or Invoice). The conversion is then reflected in the current type. This processing is initiated by selecting the appropriate Document Action. | c_invoice.C_DocTypeTarget_ID numeric(10) Table |

| Self-Service | This is a Self-Service entry or this entry can be changed via Self-Service | Self-Service allows users to enter data or update their data. The flag indicates, that this record was entered or created via Self-Service or that the user can change it via the Self-Service functionality. | c_invoice.IsSelfService character(1) Yes-No |

| Date Invoiced | Date printed on Invoice | The Date Invoice indicates the date printed on the invoice. | c_invoice.DateInvoiced timestamp without time zone Date |

| Account Date | Accounting Date | The Accounting Date indicates the date to be used on the General Ledger account entries generated from this document. It is also used for any currency conversion. | c_invoice.DateAcct timestamp without time zone Date |

| Business Partner | Identifies a Business Partner | A Business Partner is anyone with whom you transact. This can include Vendor, Customer, Employee or Salesperson | c_invoice.C_BPartner_ID numeric(10) Search |

| Partner Location | Identifies the (ship to) address for this Business Partner | The Partner address indicates the location of a Business Partner | c_invoice.C_BPartner_Location_ID numeric(10) Table Direct |

| User/Contact | User within the system - Internal or Business Partner Contact | The User identifies a unique user in the system. This could be an internal user or a business partner contact | c_invoice.AD_User_ID numeric(10) Table Direct |

| Price List | Unique identifier of a Price List | Price Lists are used to determine the pricing, margin and cost of items purchased or sold. | c_invoice.M_PriceList_ID numeric(10) Table Direct |

| Currency | The Currency for this record | Indicates the Currency to be used when processing or reporting on this record | c_invoice.C_Currency_ID numeric(10) Table Direct |

| Currency Type | Currency Conversion Rate Type | The Currency Conversion Rate Type lets you define different type of rates, e.g. Spot, Corporate and/or Sell/Buy rates. | c_invoice.C_ConversionType_ID numeric(10) Table Direct |

| Override Currency Conversion Rate | Override Currency Conversion Rate | c_invoice.IsOverrideCurrencyRate character(1) Yes-No | |

| Rate | Currency Conversion Rate | The Currency Conversion Rate indicates the rate to use when converting the source currency to the accounting currency | c_invoice.CurrencyRate numeric Number |

| Sales Representative | Sales Representative or Company Agent | The Sales Representative indicates the Sales Rep for this Region. Any Sales Rep must be a valid internal user. | c_invoice.SalesRep_ID numeric(10) Search |

| Discount Printed | Print Discount on Invoice and Order | The Discount Printed Checkbox indicates if the discount will be printed on the document. | c_invoice.IsDiscountPrinted character(1) Yes-No |

| Charge | Additional document charges | The Charge indicates a type of Charge (Handling, Shipping, Restocking) | c_invoice.C_Charge_ID numeric(10) Table |

| Charge amount | Charge Amount | The Charge Amount indicates the amount for an additional charge. | c_invoice.ChargeAmt numeric Amount |

| Payment Rule | How you pay the invoice | The Payment Rule indicates the method of invoice payment. | c_invoice.PaymentRule character(1) Payment |

| Payment Term | The terms of Payment (timing, discount) | Payment Terms identify the method and timing of payment. | c_invoice.C_PaymentTerm_ID numeric(10) Table Direct |

| Create lines from | Process which will generate a new document lines based on an existing document | The Create From process will create a new document based on information in an existing document selected by the user. | c_invoice.CreateLinesFrom character(1) Button |

| Project | Financial Project | A Project allows you to track and control internal or external activities. | c_invoice.C_Project_ID numeric(10) Table Direct |

| Activity | Business Activity | Activities indicate tasks that are performed and used to utilize Activity based Costing | c_invoice.C_Activity_ID numeric(10) Table Direct |

| Campaign | Marketing Campaign | The Campaign defines a unique marketing program. Projects can be associated with a pre defined Marketing Campaign. You can then report based on a specific Campaign. | c_invoice.C_Campaign_ID numeric(10) Table Direct |

| Trx Organization | Performing or initiating organization | The organization which performs or initiates this transaction (for another organization). The owning Organization may not be the transaction organization in a service bureau environment, with centralized services, and inter-organization transactions. | c_invoice.AD_OrgTrx_ID numeric(10) Table |

| User Element List 1 | User defined list element #1 | The user defined element displays the optional elements that have been defined for this account combination. | c_invoice.User1_ID numeric(10) Search |

| User Element List 2 | User defined list element #2 | The user defined element displays the optional elements that have been defined for this account combination. | c_invoice.User2_ID numeric(10) Search |

| Total Lines | Total of all document lines | The Total amount displays the total of all lines in document currency | c_invoice.TotalLines numeric Amount |

| Grand Total | Total amount of document | The Grand Total displays the total amount including Tax and Freight in document currency | c_invoice.GrandTotal numeric Amount |

| Document Status | The current status of the document | The Document Status indicates the status of a document at this time. If you want to change the document status, use the Document Action field | c_invoice.DocStatus character(2) List |

| Document Type | Document type or rules | The Document Type determines document sequence and processing rules | c_invoice.C_DocType_ID numeric(10) Table Direct |

| Pay Schedule valid | Is the Payment Schedule is valid | Payment Schedules allow to have multiple due dates. | c_invoice.IsPayScheduleValid character(1) Yes-No |

| In Dispute | Document is in dispute | The document is in dispute. Use Requests to track details. | c_invoice.IsInDispute character(1) Yes-No |

| Copy Lines | Copy Lines from other Invoice | c_invoice.CopyFrom character(1) Button | |

| Process Invoice | c_invoice.DocAction character(2) Button | ||

| Posted | Posting status | The Posted field indicates the status of the Generation of General Ledger Accounting Lines | c_invoice.Posted character(1) Button |

| Paid | The document is fully paid | c_invoice.IsPaid character(1) Yes-No | |

| Collection Status | Invoice Collection Status | Status of the invoice collection process | c_invoice.InvoiceCollectionType character(1) List |

| Dunning Grace Date | c_invoice.DunningGrace timestamp without time zone Date | ||

| Dunning Level | c_invoice.C_DunningLevel_ID numeric(10) Table Direct | ||

| Cash Plan Line | c_invoice.C_CashPlanLine_ID numeric(10) Search | ||

| Is Fixed Asset Invoice | c_invoice.IsFixedAssetInvoice character(1) Yes-No | ||

| Related Invoice | c_invoice.RelatedInvoice_ID numeric(10) Search |

Tab: Invoice Line

[Created: 25/01/2000 - Updated: 02/09/2005 ]

Description: Customer Invoice Line

Help: The Invoice Line Tab defines the individual items or charges on an Invoice.

Tab Level: 1

Table 20: Invoice Line - Fields

Table: Report Parameters

| Name | Description | Help | Technical Info |

|---|---|---|---|

| Tenant | Tenant for this installation. | A Tenant is a company or a legal entity. You cannot share data between Tenants. | c_invoiceline.AD_Client_ID numeric(10) Table Direct |

| Organization | Organizational entity within tenant | An organization is a unit of your tenant or legal entity - examples are store, department. You can share data between organizations. | c_invoiceline.AD_Org_ID numeric(10) Table Direct |

| Invoice | Invoice Identifier | The Invoice Document. | c_invoiceline.C_Invoice_ID numeric(10) Search |

| Line No | Unique line for this document | Indicates the unique line for a document. It will also control the display order of the lines within a document. | c_invoiceline.Line numeric(10) Integer |

| Shipment/Receipt Line | Line on Shipment or Receipt document | The Shipment/Receipt Line indicates a unique line in a Shipment/Receipt document | c_invoiceline.M_InOutLine_ID numeric(10) Search |

| Product | Product, Service, Item | Identifies an item which is either purchased or sold in this organization. | c_invoiceline.M_Product_ID numeric(10) Search |

| Charge | Additional document charges | The Charge indicates a type of Charge (Handling, Shipping, Restocking) | c_invoiceline.C_Charge_ID numeric(10) Table Direct |

| Attribute Set Instance | Product Attribute Set Instance | The values of the actual Product Attribute Instances. The product level attributes are defined on Product level. | c_invoiceline.M_AttributeSetInstance_ID numeric(10) Product Attribute |

| Resource Assignment | Resource Assignment | c_invoiceline.S_ResourceAssignment_ID numeric(10) Assignment | |

| Description | Optional short description of the record | A description is limited to 255 characters. | c_invoiceline.Description character varying(255) Text |

| Quantity | The Quantity Entered is based on the selected UoM | The Quantity Entered is converted to base product UoM quantity | c_invoiceline.QtyEntered numeric Quantity |

| UOM | Unit of Measure | The UOM defines a unique non monetary Unit of Measure | c_invoiceline.C_UOM_ID numeric(10) Table Direct |

| Quantity Invoiced | Invoiced Quantity | The Invoiced Quantity indicates the quantity of a product that have been invoiced. | c_invoiceline.QtyInvoiced numeric Quantity |

| Price | Price Entered - the price based on the selected/base UoM | The price entered is converted to the actual price based on the UoM conversion | c_invoiceline.PriceEntered numeric Costs+Prices |

| Unit Price | Actual Price | The Actual or Unit Price indicates the Price for a product in source currency. | c_invoiceline.PriceActual numeric Costs+Prices |

| List Price | List Price | The List Price is the official List Price in the document currency. | c_invoiceline.PriceList numeric Costs+Prices |

| Tax | Tax identifier | The Tax indicates the type of tax used in document line. | c_invoiceline.C_Tax_ID numeric(10) Table Direct |

| Project | Financial Project | A Project allows you to track and control internal or external activities. | c_invoiceline.C_Project_ID numeric(10) Table Direct |

| Activity | Business Activity | Activities indicate tasks that are performed and used to utilize Activity based Costing | c_invoiceline.C_Activity_ID numeric(10) Table Direct |

| Campaign | Marketing Campaign | The Campaign defines a unique marketing program. Projects can be associated with a pre defined Marketing Campaign. You can then report based on a specific Campaign. | c_invoiceline.C_Campaign_ID numeric(10) Table Direct |

| Trx Organization | Performing or initiating organization | The organization which performs or initiates this transaction (for another organization). The owning Organization may not be the transaction organization in a service bureau environment, with centralized services, and inter-organization transactions. | c_invoiceline.AD_OrgTrx_ID numeric(10) Table |

| User Element List 1 | User defined list element #1 | The user defined element displays the optional elements that have been defined for this account combination. | c_invoiceline.User1_ID numeric(10) Search |

| User Element List 2 | User defined list element #2 | The user defined element displays the optional elements that have been defined for this account combination. | c_invoiceline.User2_ID numeric(10) Search |

| Line Amount | Line Extended Amount (Quantity * Actual Price) without Freight and Charges | Indicates the extended line amount based on the quantity and the actual price. Any additional charges or freight are not included. The Amount may or may not include tax. If the price list is inclusive tax, the line amount is the same as the line total. | c_invoiceline.LineNetAmt numeric Amount |

| Description Only | if true, the line is just description and no transaction | If a line is Description Only, e.g. Product Inventory is not corrected. No accounting transactions are created and the amount or totals are not included in the document. This for including descriptive detail lines, e.g. for an Work Order. | c_invoiceline.IsDescription character(1) Yes-No |

| Printed | Indicates if this document / line is printed | The Printed checkbox indicates if this document or line will included when printing. | c_invoiceline.IsPrinted character(1) Yes-No |

| Asset | Asset used internally or by customers | An asset is either created by purchasing or by delivering a product. An asset can be used internally or be a customer asset. | c_invoiceline.A_Asset_ID numeric(10) Search |

Tab: Invoice Tax

[Created: 25/01/2000 - Updated: 02/01/2000 ]

Description: Customer Invoice Tax

Help: The Invoice Tax Tab displays the total tax due based on the Invoice Lines.

Tab Level: 1

Table 30: Invoice Tax - Fields

Table: Report Parameters

| Name | Description | Help | Technical Info |

|---|---|---|---|

| Tenant | Tenant for this installation. | A Tenant is a company or a legal entity. You cannot share data between Tenants. | c_invoicetax.AD_Client_ID numeric(10) Table Direct |

| Organization | Organizational entity within tenant | An organization is a unit of your tenant or legal entity - examples are store, department. You can share data between organizations. | c_invoicetax.AD_Org_ID numeric(10) Table Direct |

| Invoice | Invoice Identifier | The Invoice Document. | c_invoicetax.C_Invoice_ID numeric(10) Search |

| Tax | Tax identifier | The Tax indicates the type of tax used in document line. | c_invoicetax.C_Tax_ID numeric(10) Table Direct |

| Tax Provider | c_invoicetax.C_TaxProvider_ID numeric(10) Table Direct | ||

| Tax Amount | Tax Amount for a document | The Tax Amount displays the total tax amount for a document. | c_invoicetax.TaxAmt numeric Amount |

| Tax base Amount | Base for calculating the tax amount | The Tax Base Amount indicates the base amount used for calculating the tax amount. | c_invoicetax.TaxBaseAmt numeric Amount |

| Price includes Tax | Tax is included in the price | The Tax Included checkbox indicates if the prices include tax. This is also known as the gross price. | c_invoicetax.IsTaxIncluded character(1) Yes-No |

Tab: Payment Schedule

[Created: 04/05/2003 - Updated: 17/05/2005 ]

Description: Invoice Payment Schedule

Help:

Tab Level: 1

Table 40: Payment Schedule - Fields

Table: Report Parameters

| Name | Description | Help | Technical Info |

|---|---|---|---|

| Tenant | Tenant for this installation. | A Tenant is a company or a legal entity. You cannot share data between Tenants. | c_invoicepayschedule.AD_Client_ID numeric(10) Table Direct |

| Organization | Organizational entity within tenant | An organization is a unit of your tenant or legal entity - examples are store, department. You can share data between organizations. | c_invoicepayschedule.AD_Org_ID numeric(10) Table Direct |

| Invoice | Invoice Identifier | The Invoice Document. | c_invoicepayschedule.C_Invoice_ID numeric(10) Search |

| Payment Schedule | Payment Schedule Template | Information when parts of the payment are due | c_invoicepayschedule.C_PaySchedule_ID numeric(10) Table Direct |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.There are two reasons for de-activating and not deleting records:(1) The system requires the record for audit purposes.(2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. | c_invoicepayschedule.IsActive character(1) Yes-No |

| Due Date | Date when the payment is due | Date when the payment is due without deductions or discount | c_invoicepayschedule.DueDate timestamp without time zone Date |

| Amount due | Amount of the payment due | Full amount of the payment due | c_invoicepayschedule.DueAmt numeric Amount |

| Discount Date | Last Date for payments with discount | Last Date where a deduction of the payment discount is allowed | c_invoicepayschedule.DiscountDate timestamp without time zone Date |

| Discount Amount | Calculated amount of discount | The Discount Amount indicates the discount amount for a document or line. | c_invoicepayschedule.DiscountAmt numeric Amount |

| Validate | Validate Payment Schedule | c_invoicepayschedule.Processing character(1) Button | |

| Valid | Element is valid | The element passed the validation check | c_invoicepayschedule.IsValid character(1) Yes-No |

Tab: Allocation

[Created: 27/01/2005 - Updated: 17/05/2005 ]

Description: Allocation of the Invoice to Payments or Cash

Help:

Tab Level: 1

Table 50: Allocation - Fields

Table: Report Parameters

| Name | Description | Help | Technical Info |

|---|---|---|---|

| Tenant | Tenant for this installation. | A Tenant is a company or a legal entity. You cannot share data between Tenants. | c_allocationline.AD_Client_ID numeric(10) Table Direct |

| Organization | Organizational entity within tenant | An organization is a unit of your tenant or legal entity - examples are store, department. You can share data between organizations. | c_allocationline.AD_Org_ID numeric(10) Table Direct |

| Invoice | Invoice Identifier | The Invoice Document. | c_allocationline.C_Invoice_ID numeric(10) Search |

| Allocation | Payment allocation | c_allocationline.C_AllocationHdr_ID numeric(10) Search | |

| Transaction Date | Transaction Date | The Transaction Date indicates the date of the transaction. | c_allocationline.DateTrx timestamp without time zone Date |

| Payment | Payment identifier | The Payment is a unique identifier of this payment. | c_allocationline.C_Payment_ID numeric(10) Search |

| Amount | Amount in a defined currency | The Amount indicates the amount for this document line. | c_allocationline.Amount numeric Amount |

| Discount Amount | Calculated amount of discount | The Discount Amount indicates the discount amount for a document or line. | c_allocationline.DiscountAmt numeric Amount |

| Write-off Amount | Amount to write-off | The Write Off Amount indicates the amount to be written off as uncollectible. | c_allocationline.WriteOffAmt numeric Amount |

| Over/Under Payment | Over-Payment (unallocated) or Under-Payment (partial payment) Amount | Overpayments (negative) are unallocated amounts and allow you to receive money for more than the particular invoice. Underpayments (positive) is a partial payment for the invoice. You do not write off the unpaid amount. | c_allocationline.OverUnderAmt numeric Amount |